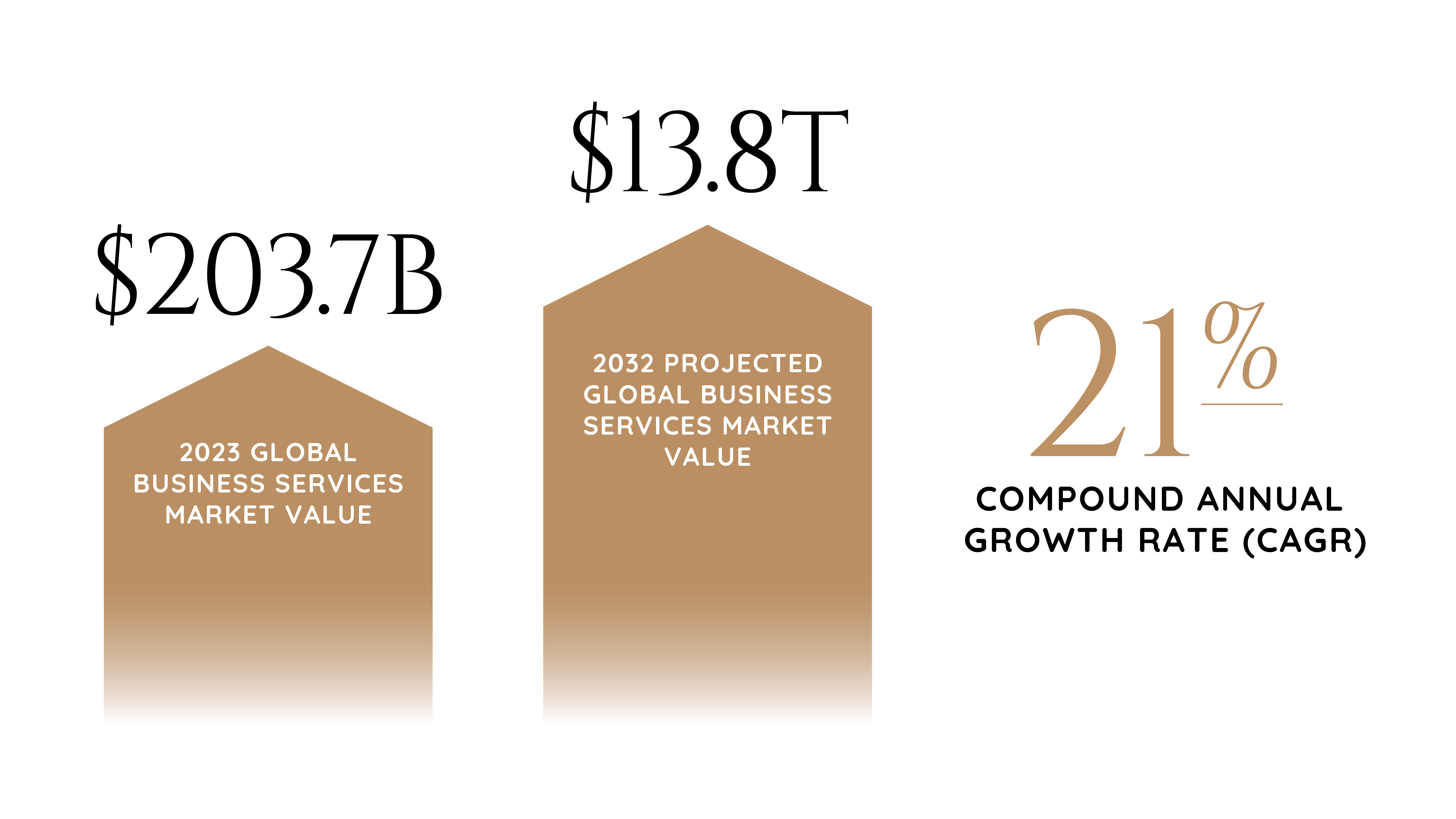

The global business services market is forecast to reach a compound annual growth rate (CAGR) of 21% from 2023 to 2032. Last year, the market was estimated to be valued at $203.7 Billion, and it is projected to reach $13.8 trillion by 2032.

The business services sector includes consulting, outsourcing, and technology solutions that enable businesses to streamline their operations, keep up with changing market conditions, and remain competitive.

The business services sector accounts for four of the 20 fastest-growing industries and is seeing a surge in demand for specialized skills such as management, scientific, and technical consulting services. As companies increasingly focus on optimizing costs, using consulting services for specific tasks rather than hiring full-time employees is a trend that is gaining momentum.

The market's growth can be attributed to remote work adoption, sustainability, data analytics and AI integration, regulatory and compliance changes, and supply chain resilience. Other significant business service trends include digital transformation, technological advancements, cybersecurity, customized business solutions, and outsourcing growth.

The overall state of the economy also plays a vital role in the growth of the business services sector. Businesses are more likely to invest in services that improve operations when the economy grows. During economic downturns, cost-saving services may be in higher demand.

The growing creation of new businesses is also expected to drive growth in the industry. Business support services provide a range of services for newly established businesses.

The business services market includes outsourcing to offshore locations, contributing to market growth. Many businesses are choosing to outsource non-core functions to specialized service providers to cut costs and boost their focus on their core competencies.

The growing need for digital marketing and e-commerce is creating more demand for services related to online advertising, search engine optimization (SEO), website development, and e-commerce platform management.

Recruiting, talent acquisition, training, and employee benefit services are all critical for companies in managing their workforces. As remote work and the gig economy evolve, the business services segment has been in higher demand for these human resources and talent management needs.

With growing global awareness of environmental and sustainability issues, there has been growth in services related to sustainability reporting, energy-efficiency consulting, and green supply-chain management.

Legal services have also been in demand as businesses look to protect their assets and navigate legal complexities, such as contract review, intellectual property protection, and compliance.

Market Segmentation

By type, the business services market is segmented into:

- Consulting

- Outsourcing

- Technology Services

By application, the market is segmented into:

- Finance

- Human Resources

- Marketing

- IT

- Legal

By Region

The United States is a significant business service player, focusing heavily on tech services and consulting. Canada's business services market focuses more on finance, HR, and technology services, emphasizing support for businesses in competitive environments.

Western European countries such as the United Kingdom, Germany, and France are primarily focused on consulting and technology services, as the market is driven by digital transformation and ESG initiatives.

Eastern European nations use more outsourcing services, especially in IT and finance. China's rapidly growing business services market is driven by tech services and consulting, heavily emphasizing innovation and digital transformation. India is an outsourcing hub that offers a wide range of services, such as IT, finance, and customer support.

Nations in the Middle East offer tech and consulting services to support businesses in different sectors, including oil and gas, finance, and technology. African countries are emerging as a region for outsourcing, focusing on IT and customer support.

M&A

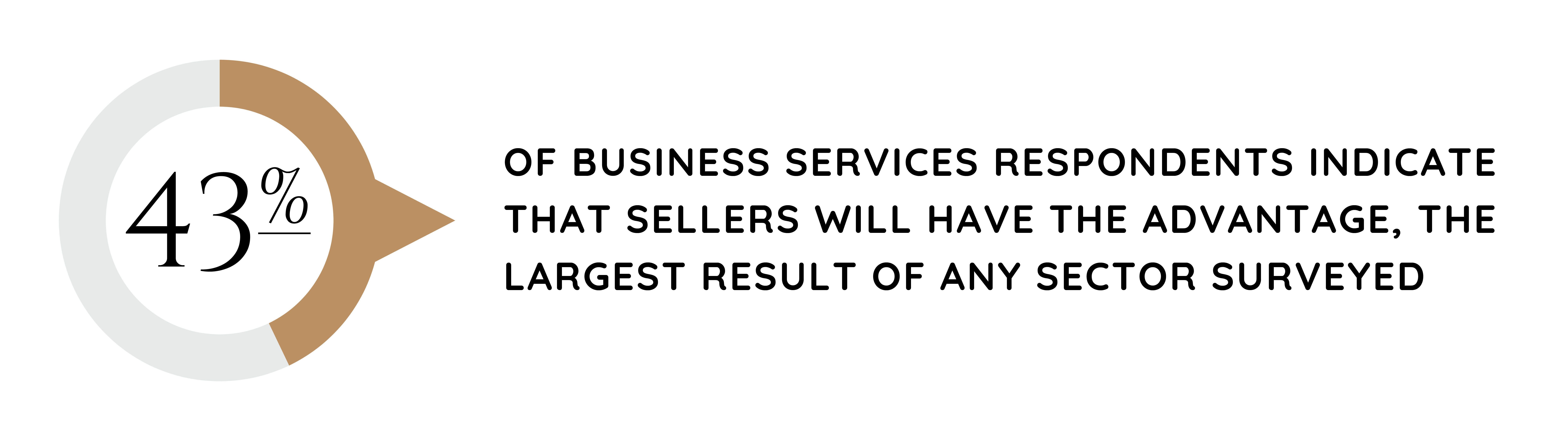

The 2024 Citizens M&A Outlook revealed that 43% of business services respondents indicate that sellers will have the advantage, the most prominent result of any sector surveyed. In the same study, private equity respondents reported the most opportunity in the business services and tech, media & telecom sectors, with business services poised for a strong M&A year as the rate environment becomes amenable.

The business services sector continues to make a compelling case for investment in 2024. Ongoing worker shortages in developed economies mean that companies with experienced and capable employees are being increasingly valued for their ability to enhance operational workflow and improve business efficiency. This makes service-centric models that deliver measurable value for clients desirable assets.

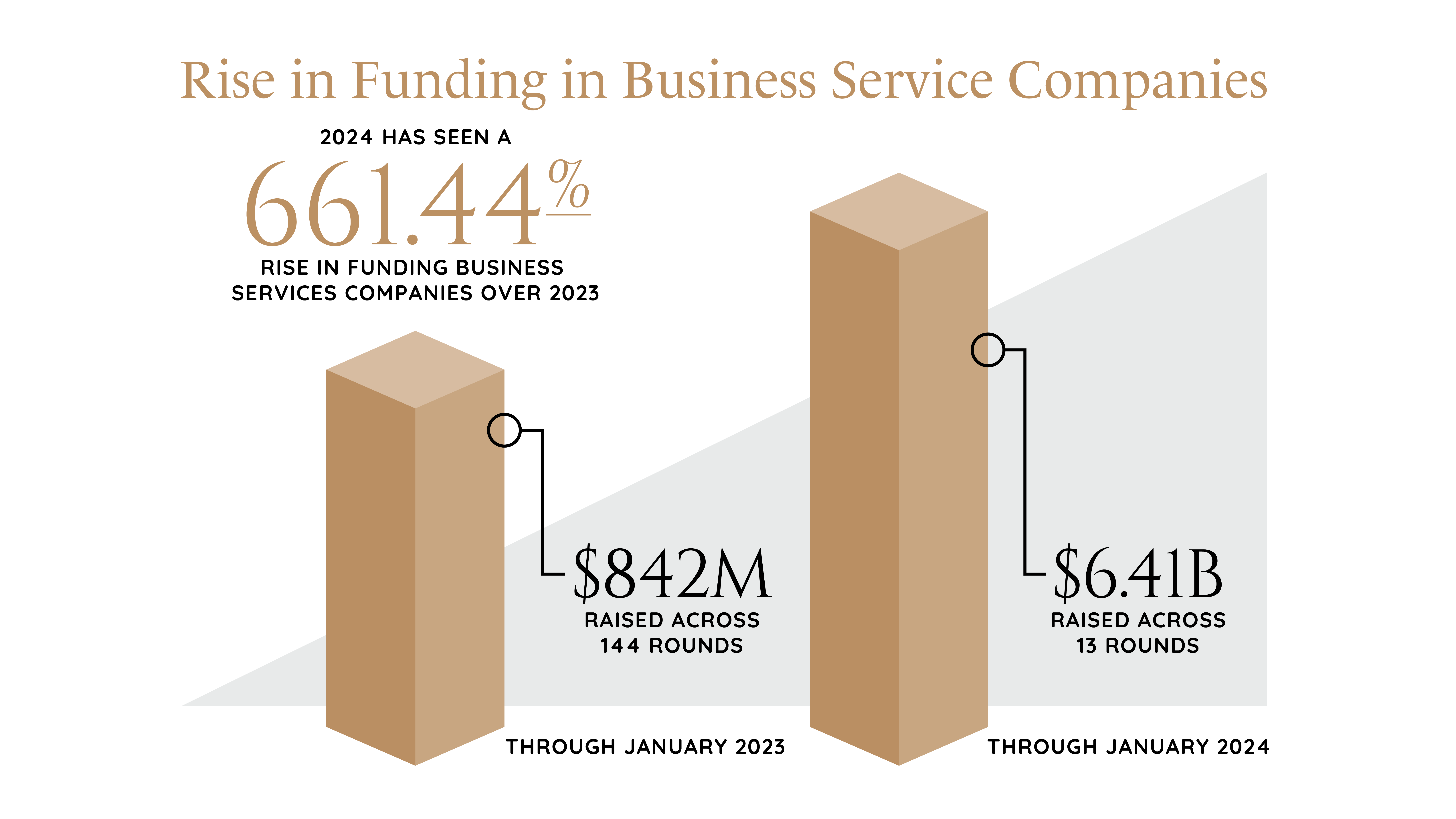

Through January 2024, the business services sector has raised $6.41 billion in equity funding across 13 rounds. In the same period last year (through January 2023), these companies raised $842 million across 144 rounds. Therefore, 2024 has seen a 661.44% rise in funding in business services companies over 2023.

There is an ongoing need for more cybersecurity due to increased data breaches, newer mobile technologies, and custom programming services. This need will increase actual output in the business services sector and create opportunities for M&A strategies.

As businesses expand globally, they need services related to international market entry, cross-border transactions, trade, and international marketing. This is leading to growth in the global business services space.

Categories

Get These Insights Delivered Directly To Your Email

Explore our curated collection today and stay ahead of the curve in M&A.