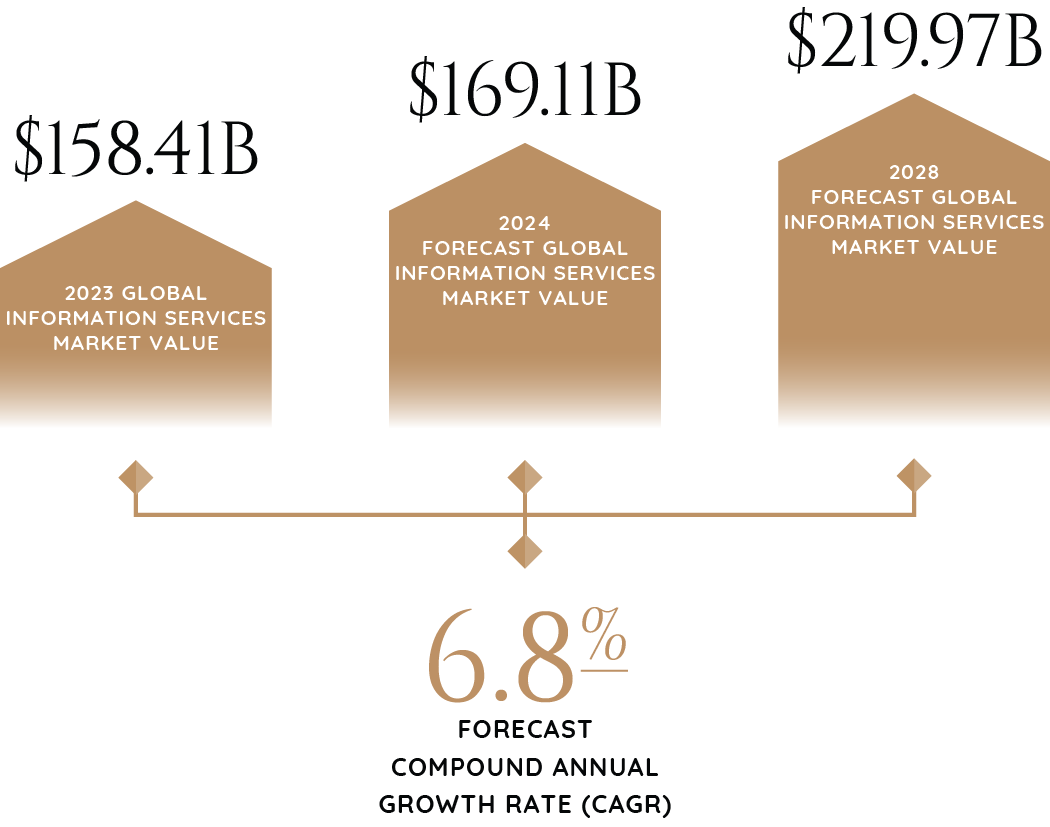

- The global information services market is growing at a compound annual growth rate (CAGR) of 6.8% from $158.41 billion in 2023 to $169.11 billion in 2024. Over the next few years, the market is predicted to grow at a similar pace, continuing to surge at a CAGR of 6.8% to reach $219.97 billion by 2028.

Market Segmentation

The information services industry is segmented into the following categories:

- By Type: News Syndicates, Libraries, Archives, and Other

- By Deployment Mode: On-Site, in the Cloud

- By End-User: B2B, B2C, Automotive, Healthcare, Retail, Manufacturing, Banking and Capital

Market Trends and Drivers

The historical growth in today’s information services sector can be attributed to globalization, the need for remote work and collaboration tools, regulatory changes and data privacy, growing e-commerce, the prevalence of mobile devices, cybersecurity concerns, and content explosion.

Artificial intelligence (AI) in information management will also continue to be a major driver of market growth over the next few years, as well as the integration of big data in information services provider offerings and the growing banking, financial services, and insurance (BFSI) sector.

Green initiatives are also leading to a sizable demand in the market with the need for sustainable information practices. The trend toward providing personalized user experiences is also playing a significant role in the industry, as are the areas of data monetization and blockchain technology.

Social media is also expected to drive the demand for information services as more people use various social platforms to share information and connect with friends and family. As billions of people spend time on social networking sites, it drives the growth of the Internet publishing and broadcasting sectors. The ongoing surge in the use of social media is expected to create growth in the information services market via more demand for news, online libraries, and archives.

Your Business, Our Expertise – A Winning Combination.

An increasing demand for IT services also drives growth in the information services market. More and more businesses have the need to create, manage, optimize, and access information and business processes. Monitoring networks, web traffic, and other connected devices is also necessary. Such a level of monitoring helps IT personnel be aware of everyone accessing their company's information if repairs are needed, and whether software upgrades or adjustments are necessary.

Another area that is driving the information services industry is the transformation of libraries in the public space as well as at universities and colleges. It is changing how they facilitate access to books, audio, and video content through digital platforms and technologies offering content through various devices. There is also the development of new applications for desktops, mobile phones, and tablets, with a focus on responsive design and device compatibility to enhance user experiences.

By Region

The Asia-Pacific region was the largest in the information services market in 2023. The Middle East is expected to be the fastest-growing region over the next year.

M&A

Major players operating within the information services market are focusing heavily on strategic collaborations to meet the needs of their existing customers better and deliver the most relevant information in demand. Creating synergies and enhanced distribution capabilities are vital goals for many information services companies in their value-driving M&A playbook.

The growing emergence of AI is also creating an environment for media and tech companies to vie for value by enhancing their existing services, which means adding AI-powered services to the mix through M&A strategies. AI tools are also helping companies improve their market research capabilities by analyzing consumer behaviors and trends. This is driving the need for businesses to up what’s in their AI toolbox, and M&A deals are one of the best ways to accomplish this.

Environmental, social, and governance (ESG) analytics data is also becoming a competitive advantage for businesses as the sustainability boom continues. Top companies have already been implementing ESG as a priority business strategy. However, there is an ongoing need for access to quality ESG information beyond just reading a company’s sustainability report. M&A strategies can help these businesses accomplish their ESG goals, among other important objectives.

Categories

Get These Insights Delivered Directly To Your Email

Explore our curated collection today and stay ahead of the curve in M&A.