In 2021, the global heating, ventilation, and air conditioning (HVAC) market was valued at $156.44 billion. The market is expected to be valued at $231.11 billion by 2027, expanding at a compound annual growth rate (CAGR) of 6.72% between 2022 and 2027.

Trends and Market Drivers

A key driver of the HVAC industry is the increasing adoption of sustainable buildings, smart buildings, net-zero buildings, and the shift toward energy efficiency. Many manufacturers focus on green initiatives to lower greenhouse gas emissions and save money. The goal of these buildings is to reduce energy consumption. As a result, eco-friendly HVAC units that use less power and renewable energy sources are growing in popularity, especially as populations become more aware of energy-efficient HVAC equipment. This includes green-labeled products such as thermally driven air conditioners that use natural gas and solar energy. They also offer lower maintenance, automatic adjustments, independent control of pipes, and improved lifetime costs.

As modern consumers prefer more comfort, it opens up new HVAC opportunities. Products that use cutting-edge technologies are being created for improved connectivity and smart units that can be controlled via smartphone or computer. HVAC systems that use software are also growing more popular and creating opportunities in the industry. As technology slowly infiltrates the HVAC market, there are more and more opportunities for long-term growth.

Other growth drivers in the market include

- growing populations,

- increasing construction initiatives,

- a growing smart thermostat market,

- increasing temperatures,

- escalating e-commerce retail sales,

- rising disposable incomes, and

- rapid urbanization.

According to the International Energy Agency (IEA), global energy demand from air conditioning units is expected to triple by 2050, with the global stock of air conditioners in buildings growing to 5.6 billion.

The HVAC service market is directly correlated with the HVAC equipment market. As demand for equipment rises, so makes the demand for installation or retrofitting services. Today’s HVAC services focus on improving the performance of the equipment and potentially reducing energy costs.

A growing preference for condensing boilers also leads to HVAC market growth. Furnace-based technology is prominent in North America and Asia, while kettle systems dominate Europe. Boiler systems are based on radiant or convection heat, which offers continuous heat with consistent temperature. Other advantages include advanced controls, easy maintenance, and a longer boiler life.

Market Challenges

Some of the challenges the HVAC industry faces include the increasing costs of raw materials such as copper and iron, more government regulations, data infrastructure security, and retail consolidations.

Market Segmentation

The fastest-growing market segment is the residential segment, growing at CAGR of around 9% through 2027. An increase in multi-family and individual homeowners is creating opportunities within the residential HVAC space, especially in developing markets.

Last year, the Asia Pacific region dominated the HVAC market, accounting for more than half of the revenue. This can be attributed to rapid urbanization, population growth, and rising consumer disposable income. North America was the second-largest consumer of HVAC systems, followed by Europe. Over the forecast period, the North American region is expected to grow at a CAGR of more than 7%.

Market Landscape

The HVAC market is moderately concentrated and highly competitive. To gain a competitive edge, market players are focusing on research and development to develop technologically advanced and unique products. Technology and energy efficiency are in the spotlight regarding relevance and profitability. Companies are also creating products that adhere to regional regulations in order to avoid losing business due to regulatory violations. Additionally, to gain a stronger position in the market, some leading firms are pursuing growth through mergers, acquisitions, collaborations, and agreements. Some are also focusing on expansion into foreign countries to increase market share and boost the bottom line. Some are also acquiring start-ups in order to access new technologies and capabilities.

If you own an HVAC business, now is an excellent time to sell, as the market is hot and valuations are up. Our M&A experts at Benchmark International would love to hear from you and discuss your options, as well as how we can get you the best deal possible.

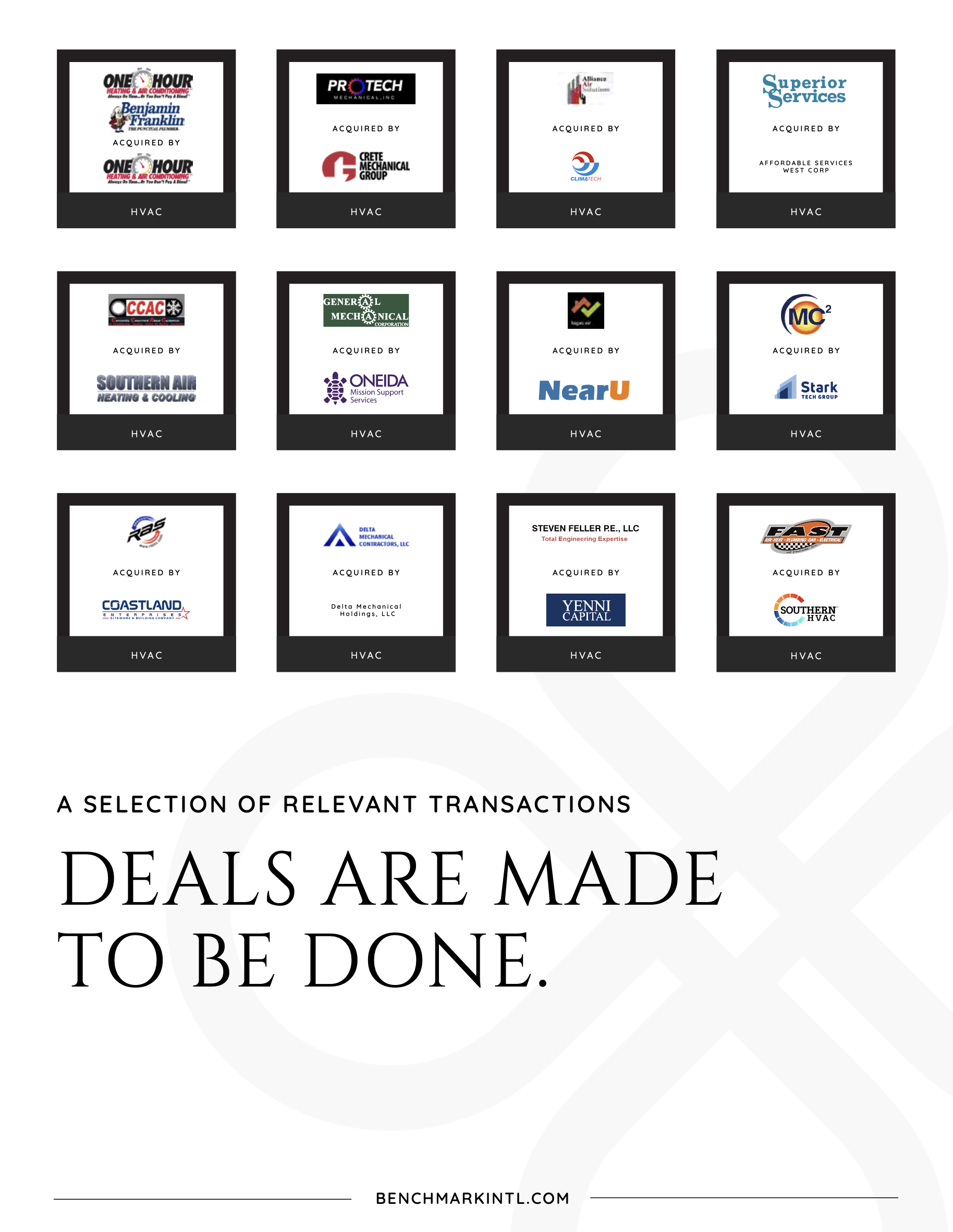

A selection of relevant transactions facilitated by Benchmark International

Categories

Get These Insights Delivered Directly To Your Email

Explore our curated collection today and stay ahead of the curve in M&A.